Introduction

Stock market price prediction sounds fascinating but is equally difficult. In this article, we will show you how to write a python program that predicts the price of stock using machine learning algorithm called Linear Regression. We will work with historical data of APPLE company. The data shows the stock price of APPLE from 2015-05-27 to 2020-05-22. In this article, our aim is to implement a machine learning algorithm (Linear Regression) to predict stock price of APPLE company.

Table of Content

- Data Preprocessing

- Splitting Dataset

- Model Building (linear Regression)

- Predictions and Model Evaluation

- Predicted vs Actual Prices

- Conclusion

Let’s see how to predict stock prices using Machine Learning and the python programming language. we will start this task by importing all the necessary python libraries that we need for this task:

# Importing libraries import numpy as np from numpy import array import pandas as pd from sklearn import preprocessing from sklearn.model_selection import train_test_split from sklearn.linear_model import LinearRegression import matplotlib.pyplot as plt import seaborn as sns from sklearn.preprocessing import MinMaxScaler from sklearn.linear_model import LinearRegression import math from sklearn.metrics import mean_squared_error

Data Preprocessing

We would be using the Apple Inc. stock scrip data for this project. We have a historic data set from 27th May 2015 to 22nd May 2020. A copy of the data used is kept over here. Click on the Apple Stock Download data to get a csv file format copied on your disk.

df = pd.read_csv('AAPL.csv')

We will have a look at the dataset using df.head(), it will show the first 5 entries of the dataset.

pd.set_option('display.max_columns', None)

df.head()

Unnamed: 0 symbol date close high low open volume adjClose adjHigh adjLow adjOpen adjVolume divCash splitFactor

0 0 AAPL 2015-05-27 00:00:00+00:00 132.045 132.260 130.05 130.34 45833246 121.682558 121.880685 119.844118 120.111360 45833246 0.0 1.0

1 1 AAPL 2015-05-28 00:00:00+00:00 131.780 131.950 131.10 131.86 30733309 121.438354 121.595013 120.811718 121.512076 30733309 0.0 1.0

2 2 AAPL 2015-05-29 00:00:00+00:00 130.280 131.450 129.90 131.23 50884452 120.056069 121.134251 119.705890 120.931516 50884452 0.0 1.0

3 3 AAPL 2015-06-01 00:00:00+00:00 130.535 131.390 130.05 131.20 32112797 120.291057 121.078960 119.844118 120.903870 32112797 0.0 1.0

4 4 AAPL 2015-06-02 00:00:00+00:00 129.960 130.655 129.32 129.86 33667627 119.761181 120.401640 119.171406 119.669029 33667627 0.0 1.0

[5 rows x 15 columns]

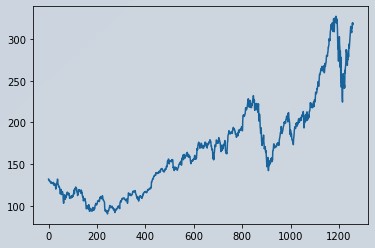

# Closing Price

df1 = df['close']

df['close'].plot()

Figure 1 : Apple Stock Market Data Visualization

Scaling Data

Before we begin our model fitting, lets normalize this data. This will boost the performance. It is clear that the df1 is a vector. But the problem is MinMaxScaler works on numpy 2D arrays, not on vectors. So, we will convert df1 to 2D array using np.array(df1).reshape(-1,1)) and then apply the scaling.

df1 = np.array(df1)

df1 = df1.reshape(-1,1)

scaler = MinMaxScaler(feature_range=(0,1))

df1 = scaler.fit_transform(df1)

print(df1)

[[0.17607447]

[0.17495567]

[0.16862282]

...

[0.96635143]

[0.9563033 ]

[0.96491598]]

Splitting Data into Training and Testing Set

df1.shape

(1258, 1)

In this analysis we will split the dataset into 65% training and 35% testing set. Lets split our data into training and testing sets as a standard process.

# splitting dataset into train and test split

training_size = int(len(df1)*0.65)

test_size = len(df1)-training_size

train_data,test_data =df1[0:training_size,:], df1[training_size:len(df1),:1]

train_data.shape

(817, 1)

test_data.shape

(441, 1)

training_size, test_size

(817, 441)

train_data[:10]

array([[0.17607447],

[0.17495567],

[0.16862282],

[0.1696994 ],

[0.16727181],

[0.16794731],

[0.16473866],

[0.16174111],

[0.1581525 ],

[0.15654817]])

Converting Array of Matrix into a Dataset Matrix

Now we will write a function that will prepare the dataset so that we can fit it easily in the Linear Regression model.

Windowing Dataset

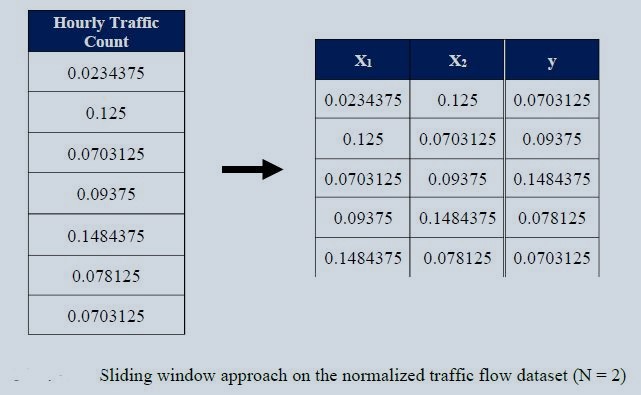

For better performance of any time series (univariate), it is necessary to use the splitting window on the dataset. The concept is simple. We will convert the dataset into several overlapping series. You will have an idea by seeing the picture below.

Figure 2 : Specimen Sliding Window Approach on Normalized Traffic Flow Data

Figure 2, shows the window size = 2. We will be using suitable window size for the best performance. You can try with any number you want. It is a hyper parameter that is needed to be tuned.

def create_dataset(dataset, time_step=1):

dataX, dataY = [], []

for i in range(len(dataset)-time_step-1):

a= dataset[i:(i+time_step), 0]

dataX.append(a)

dataY.append(dataset[i+ time_step, 0])

return np.array(dataX), np.array(dataY)

Let's choose window size = 100 for now and apply the windowing on training and testing data's

time_step = 100

X_train, y_train = create_dataset(train_data, time_step)

X_test, y_test = create_dataset(test_data, time_step)

train_data.shape, test_data.shape

((817, 1), (441, 1))

# A total of 817 + 441 = 1258

# allocate series of 817 from index 1 to 817

trainplot = np.arange(1,818)

# allocate series of 818 to 1258

testplot = np.arange(818,1259)

# Ploting Train and Test Data

plt.figure(figsize=(12,8))

plt.plot(trainplot,scaler.inverse_transform(train_data)[:,0], 'green', label='Train data')

plt.plot(testplot, scaler.inverse_transform(test_data)[:,0],'blue', label='Test data')

plt.legend()

plt.title('Train and Test Data')

plt.show()

Figure 3 : Apple Stock Market Data Visualization Train and Test Series

Model Building (linear Regression)

Now it's time to build our model ::::: LinearRegression

model = LinearRegression()

model.fit(X_train, y_train)

LinearRegression()

Predictions and Model Evaluation

Predictions of Testing Set ::::: Now we visualize how our models perform within the test set

predictions = model.predict(X_test)

print("Predicted Value",predictions[:10][0])

print("Expected Value",y_test[:10][0])

Predicted Value 0.26591241262096627

Expected Value 0.2727349489149709

pred_df= pd.DataFrame(predictions)

pred_df['TrueValues']=y_test

new_pred_df=pred_df.rename(columns={0: 'Predictions'})

new_pred_df.head()

Predictions TrueValues

0 0.265912 0.272735

1 0.267869 0.276619

2 0.289373 0.280672

3 0.286837 0.265811

4 0.264365 0.268429

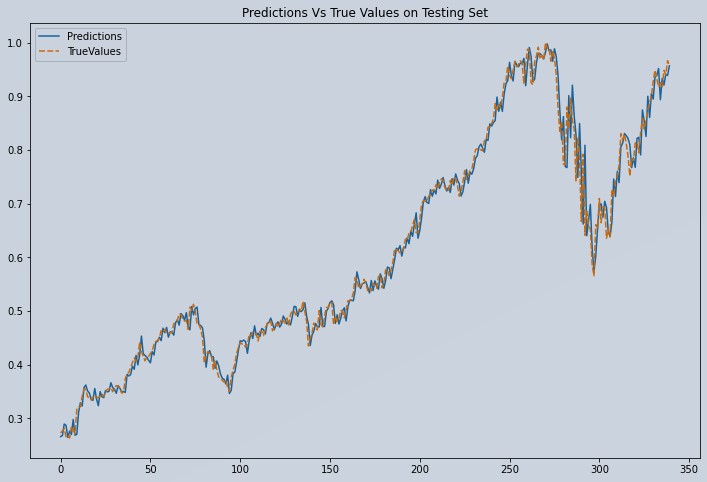

Plot Predicted vs Actual Prices of Test Series

plt.figure(figsize=(12,8))

sns.lineplot(data=new_pred_df)

plt.title("Predictions Vs True Values on Testing Set")

Text(0.5, 1.0, 'Predictions Vs True Values on Testing Set')

Figure 4: Plot of Predicted vs Actual Apple Stock Test Data

print("model Accuracy on training data:",model.score(X_train, y_train))

model Accuracy on training data: 0.9970342320018716

# Model accuracy on Testing data

print("model Accuracy is on training data:",model.score(X_test, y_test))

model Accuracy on testing data: 0.9847722212152704

# Lets Do the prediction and check performance metrics

train_predict = model.predict(X_train)

test_predict = model.predict(X_test)

train_predict = train_predict.reshape(-1, 1)

test_predict = test_predict.reshape(-1, 1)

# Transform back to original form

train_predict = scaler.inverse_transform(train_predict)

test_predict = scaler.inverse_transform(test_predict)

# Calculate RMSE performance metrics

math.sqrt(mean_squared_error(y_train,train_predict))

142.1363100026703

# Test Data RMSE

math.sqrt(mean_squared_error(y_test,test_predict))

238.13157949250507

Conclusion

Our model performed good at predicting the Apple Stock price using a Linear Regression model. This entire code stack can be reused in any stock price prediction. This prediction is only short-term. We wont recommend to use this model for medium to long term forecast periods, as it depreciates in performance. Not because our Linear model is bad, but, because Stock markets are highly volatile. Read through this implementation of Stock price prediction using LSTM.

About the Author's:

Write A Public Review